The Minsky Moment: When Stability Turns Predator and Opportunity Hunts the Brave

Dec 05, 2025

Intro: Why Financial Fragility Is Predictable, Profitable, and Psychologically Engineered

Hyman Minsky understood a brutal truth that still unnerves policymakers: markets do not implode because of chaos. They implode because of comfort. Prosperity encourages risk. Risk encourages leverage. Leverage invites fragility. Fragility guarantees the snap. Every boom carries its own seed of destruction. The “Minsky Moment” is simply the instant that seed blooms.

Investors treat stability as reassurance. Minsky treated it as a warning. When people believe nothing can go wrong, they borrow more. They stretch balance sheets. They layer risk. They assume tomorrow will mirror today. That is the psychological drift that fuels every financial accident.

Kahneman captured the mental flaw driving it: “What you see is all there is.” People extrapolate the present into eternity until the market rips that illusion apart.

The Anatomy of a Collapse: How the Fuse Actually Burns

The progression is always the same.

- Hedge finance: Borrowing is safe, income covers interest.

- Speculative finance: Borrowing expands, interest can be paid but principal must be rolled over.

- Ponzi finance: Borrowers rely on rising asset prices to refinance at all.

When the system tilts into Ponzi mode, a single shock triggers the cascade. Leverage unwinds. Prices gap. Liquidity evaporates. Forced sellers become the market. The Minsky Moment arrives not as a surprise but as an inevitability.

Marie Curie said nothing should be feared, only understood. Applied here, fear is the fog investors suffocate in because they fail to understand the structure that produced it.

Mass Psychology: Where Crashes Are Actually Formed

Markets do not break because of numbers. They break because of behaviour. The herd drives the cycle through emotional contagion.

- Euphoria fuels leverage.

- Leverage fuels fragility.

- Fragility fuels panic.

- Panic fuels collapse.

The moment optimism turns to doubt, the system begins its slide. You see it in credit spreads. You see it in implied volatility. You see it in liquidity premiums widening before anyone admits trouble. People think crashes are sudden. They are not. They are slow psychological decompressions that finally rupture.

Technical + Behavioral Synergy: Detecting the Turn Before the Crowd

Technical indicators alone do not expose fragility. Behavioral data alone does not signal timing. Combine them and you begin to see the cracks before they become chasms.

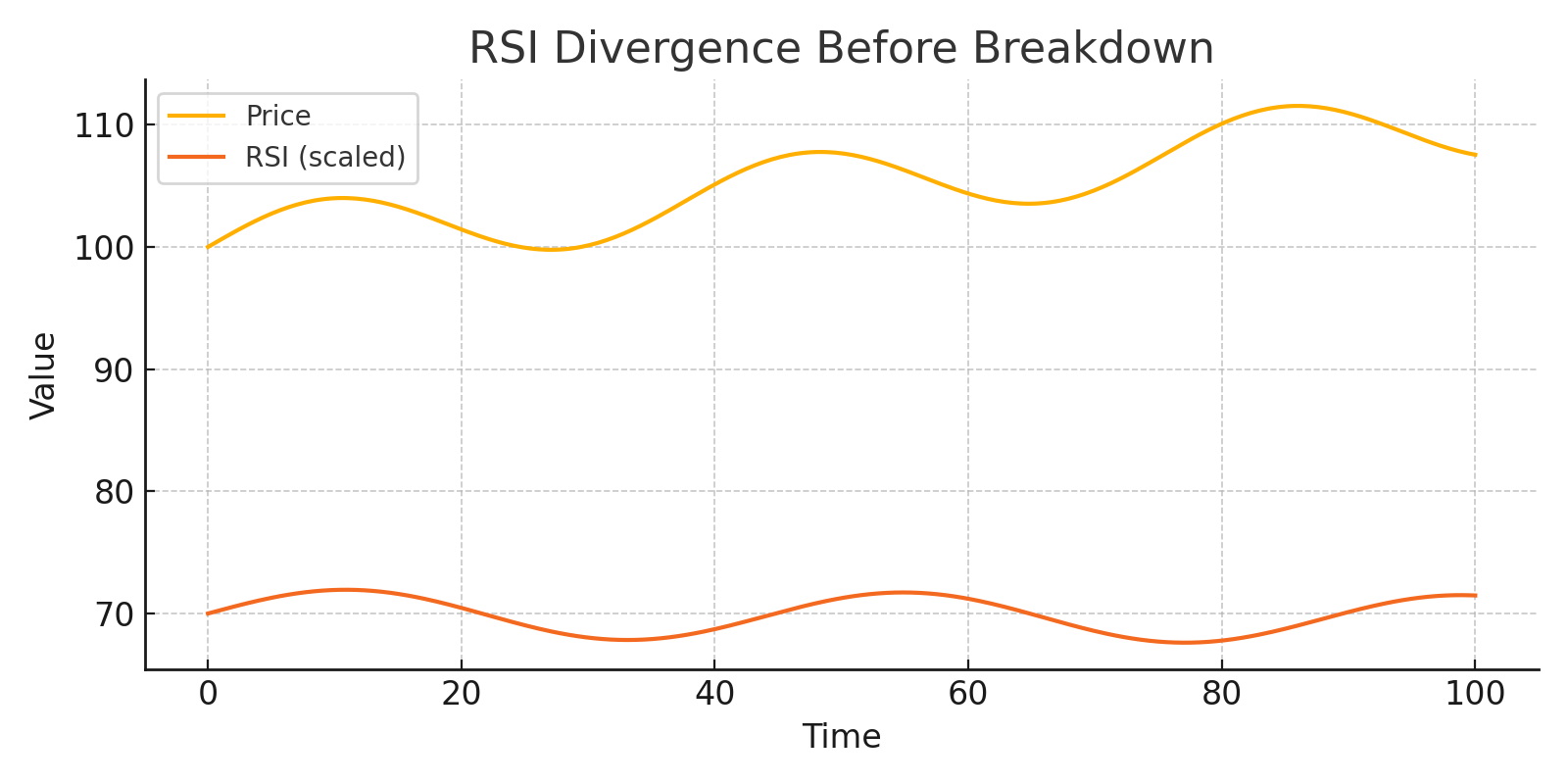

RSI and MACD flag exhaustion patterns.

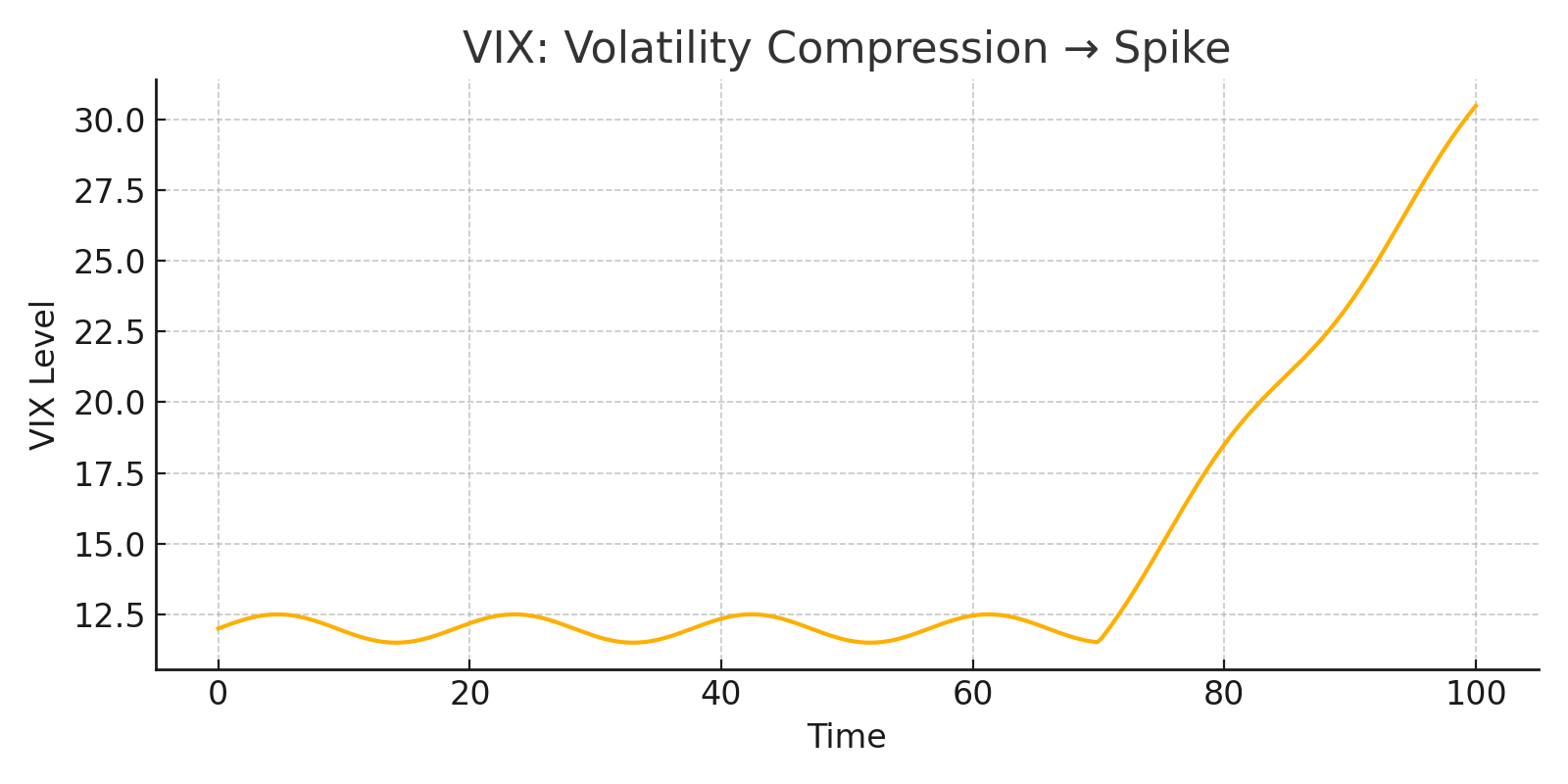

VIX maps fear’s acceleration.

Credit default swap spreads reveal stress beneath the surface.

Liquidity indicators (like TED spread or OIS-Libor) expose interbank distrust.

The next evolution is blending these into a single pressure gauge.

The Minsky Momentum Indicator (MMI)

A hybrid model combining:

- VIX volatility skew

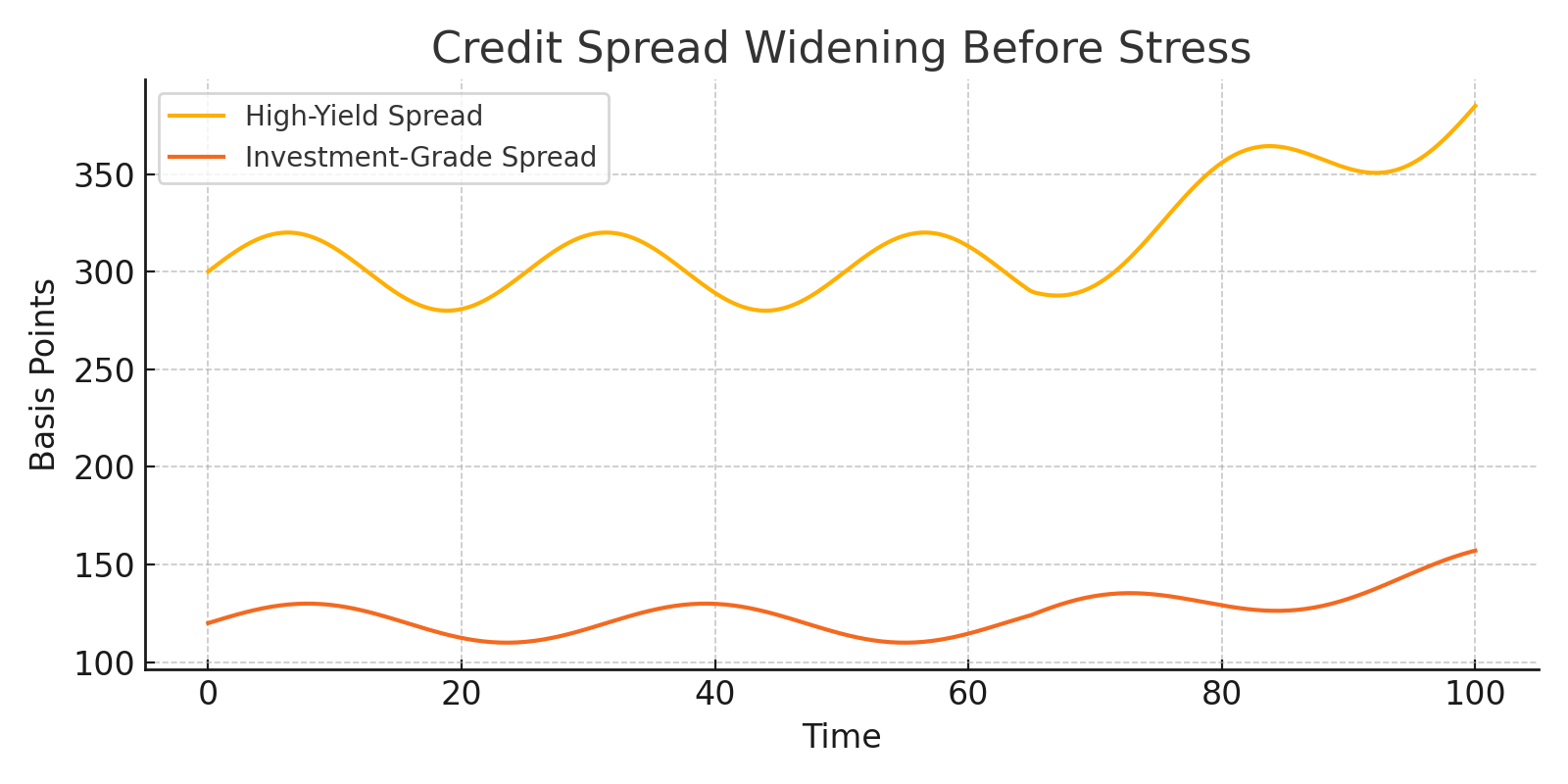

- High-yield and investment-grade credit spreads

- Equity momentum exhaustion patterns

- Social sentiment data (fear clusters, panic language, liquidity stress narratives)

This framework tracks psychological tightening in real time. When volatility spikes, spreads widen, and sentiment fractures while RSI diverges, fragility is no longer theoretical. It is active. That is where Minsky Moments germinate.

Fragility Build-Up Before a Minsky Moment: Volatility, Credit Stress, and Momentum Exhaustion

VIX (Volatility Index) – Fear Compression → Fear Spike

Highlight Zones:

• Extended period of low volatility compression

• Sudden vertical spike marking panic ignition

Credit Spreads (High Yield vs Investment Grade) – Stress Migration

Highlight Zones:

• Slow, early widening (hidden fragility)

• Rapid divergence before liquidity breaks

RSI Divergence on Major Index (S&P 500) – Momentum Exhaustion

Highlight Zones:

• Initial divergence

• Secondary divergence right before breakdown”

Footer

A true Minsky Moment occurs when volatility compression, credit stress, and momentum exhaustion converge. Where these three lines bend together, markets break.

Beyond Classical Models: The Quantum Market Lens

Von Neumann once warned that randomness generated deterministically is self-deception. Markets behave like probabilistic systems, not linear machines. Viewing them through quantum analogies offers insight.

A market does not sit in one state. It sits in multiple potential states simultaneously, until pressure forces one outcome. A Minsky Moment collapses the probability wave.

Quantum financial forecasting (QFF), still in its infancy, uses quantum algorithms to simulate vast state trees and map the probability of sudden regime shifts. The promise is not a perfect prediction but a superior anticipation.

Quantum computers do not ask “When will it collapse?”

They ask “Which collapse paths are emerging?”

That distinction will define the next era of risk management.

The Machiavellian Investor: Turning Collapse Into Fuel

Machiavelli argued that the wise act early while the fool reacts late. The Minsky-aware investor positions before fragility becomes visible.

1. Asymmetric Option Structures

Volatility mispricing during early stress phases creates cheap convexity. Long-vol structures, dynamic straddles, and forward vol spreads become weapons.

2. Credit Crash Harvesting

Buying credit default swaps on unstable sectors replicates the Paulson 2008 playbook. Fragility always shows in credit before equities.

3. Behavioural Arbitrage

Extreme sentiment readings, parabolic search trends, and herd clustering reveal where the crowd is trapped.

4. Liquidity Breakout Trades

When liquidity thins, the price responds violently to small orders. High-frequency systems exploit that vacuum.

5. Cross-Asset Momentum Rotations

Minsky Moments create contagion. Bonds influence equities, commodities influence currency flows, and volatility influences everything. Algorithms trained on correlation shifts surf these waves.

Minsky investors are not spectators of chaos. They are harvesters of it.

The Ethical Abyss: Power, Incentives, and Manipulation

Plato’s cave warns that people mistake shadows for truth. Markets operate in a similar illusion. Incentives shape perception far more than data.

Charlie Munger summed it up: “Show me the incentive, and I will show you the outcome.”

If profits reward fragility, fragility grows.

If attention rewards fear, fear grows.

If algorithms reward volatility, volatility grows.

Exploiting Minsky Moments without acknowledging the systemic consequences is intellectual negligence.

A Minsky Ethical Framework (MEF) is not idealism. It is self-preservation.

- Transparency protocols for large systemic trades

- Mandatory contribution to stabilisation reserves for funds profiting from crises

- AI-driven circuit breakers that pause markets when feedback loops accelerate

Fragility is not inevitable. It is engineered. It can be redesigned.

Case Studies: When Minsky Moments Turned Into Fortunes

2008: Subprime Implosion

Paulson saw leverage and weak collateral quality. His payoff: $15 billion.

2000–2002: Dot-Com Collapse

Chanos shorted companies with no earnings and hallucinated valuations.

2020: COVID Crash

Ackman’s $27 million hedge ballooned into $2.6 billion as credit stress exploded.

2021: GameStop Dislocation

Not a classic Minsky Moment, but a real-time demonstration of fragility created by crowd coordination, options gamma pressure, and liquidity gaps.

Each example shows one truth: Minsky Moments are not disasters for prepared minds. They are accelerants.

The Future: Quantum-AI Identifiers of Systemic Fragility

We are entering an age where AI reads patterns no human can detect. It scans unstructured data: satellite traffic, supply chain logs, dark pool activity, credit flows, and social fear language. Combine that with quantum probability simulations and a new species of fund emerges.

Quantum-AI hedge funds will not guess the next Minsky Moment.

They will map its probability roots before they sprout.

This is not science fiction. It is the trajectory.

Conclusion: The Philosopher’s Stone Hidden in Chaos

The Minsky Moment is finance’s alchemical paradox: a point where collapse and opportunity merge. It tests leverage, psychology, and belief. It exposes human weakness while rewarding strategic clarity.

But not all that glitters is gold. Profiting from instability without ethical guardrails feeds the very fragility investors pretend to master.

The lesson is simple and savage:

Understand the machine. Respect the psychology. Exploit the opportunity. Protect the system.

Minsky Moments force us to face what markets really are: human behaviour wearing the mask of economics. Those who study that mask with precision step into chaos with a scientist’s curiosity and emerge with the philosopher’s wisdom.

That is the true power of understanding fragility.